How ‘due’ is your diligence?

The ‘when, ‘where’ & ‘how’ you perform & realise value against time, location & resource is in your data. We go beyond ‘due’ diligence to rapid discovery where reality bites & frames your go-forward options.

90% of mergers disappoint & 50% of M&A deals failthe pace of business has accelerated hugely & with that the time frame for decision-making has shortened commensurately.

due diligence is out of step with the 21C!

Due diligence is anachronousIt predates the internet, when business was a lot simpler.

Your financial, legal & commercial diligence now relies on technological diligence: within the 21C systems holding the people, process & performance data.

Their challenges include::

Their challenges include::

Without systems & data discovery, due diligence is incomplete.

Due diligence is unresponsiveDecision-makers may no longer have the luxury of time.

Diligence does require thoroughness & precision but it now also needs to be fast on its feet when required.

It can no longer be content with manual, ponderous effort – not in a climate where decisions need to be made almost in real time.

Decision-makers may want a preliminary evaluation, sufficient to make initial determinations, perhaps before committing to more traditional due diligence.

Or they may want to gain insights that they have been hitherto unable to get from traditional approaches.

Either way, there is a need for both deeper & faster insights if you are serious about risk management.

It can no longer be content with manual, ponderous effort – not in a climate where decisions need to be made almost in real time.

Decision-makers may want a preliminary evaluation, sufficient to make initial determinations, perhaps before committing to more traditional due diligence.

Or they may want to gain insights that they have been hitherto unable to get from traditional approaches.

Either way, there is a need for both deeper & faster insights if you are serious about risk management.

Disruption means tough decisions need to be taken at speed.

digital firsttechnology is intrinsic to 21C life, so if ‘IT structure’ is last on the ‘due diligence’ list then something is wrong because corporate manoeuvres are awash with:

diligence begins with data!

Discover deeper, faster!Our team has decades of experience in critical information needs, corporate finance & technology which means we understand:

We drill down from financial reports to analyse & understand what the supporting data tells us about the business, its performance, processes, operations, resources, challenges & choices.

Our expertise in information & technology gives us a 360° view that cuts across existing departmental lines. This, allied with our breadth of multidisciplinary expertise, enables us to go beyond traditional diligence; to find what others may have missed.

Our independence enables us to provide the ‘tough love’ commentary that you may not get internally.

And finally, we’ve walked in your shoes – should you need a critical friend.

Our expertise in information & technology gives us a 360° view that cuts across existing departmental lines. This, allied with our breadth of multidisciplinary expertise, enables us to go beyond traditional diligence; to find what others may have missed.

Our independence enables us to provide the ‘tough love’ commentary that you may not get internally.

And finally, we’ve walked in your shoes – should you need a critical friend.

Discovery improves your brief to your legal & financial teams.

cui bono?diligent discovery will benefit CEOs who want rapid insight into a target or even their own organisation should they be contemplating:

all you need to know, yesterday!

Res ipsaFor too long, diligence has been focused on res ipsa, instead of on the business & its future.

Having multi-disciplinary experience, as well as core diligence skills, our breadth of knowledge enables us to deliver rapid & searching insights others may have overlooked, via a menu of research, analytics, modelling, forecasting & scenario evaluation.

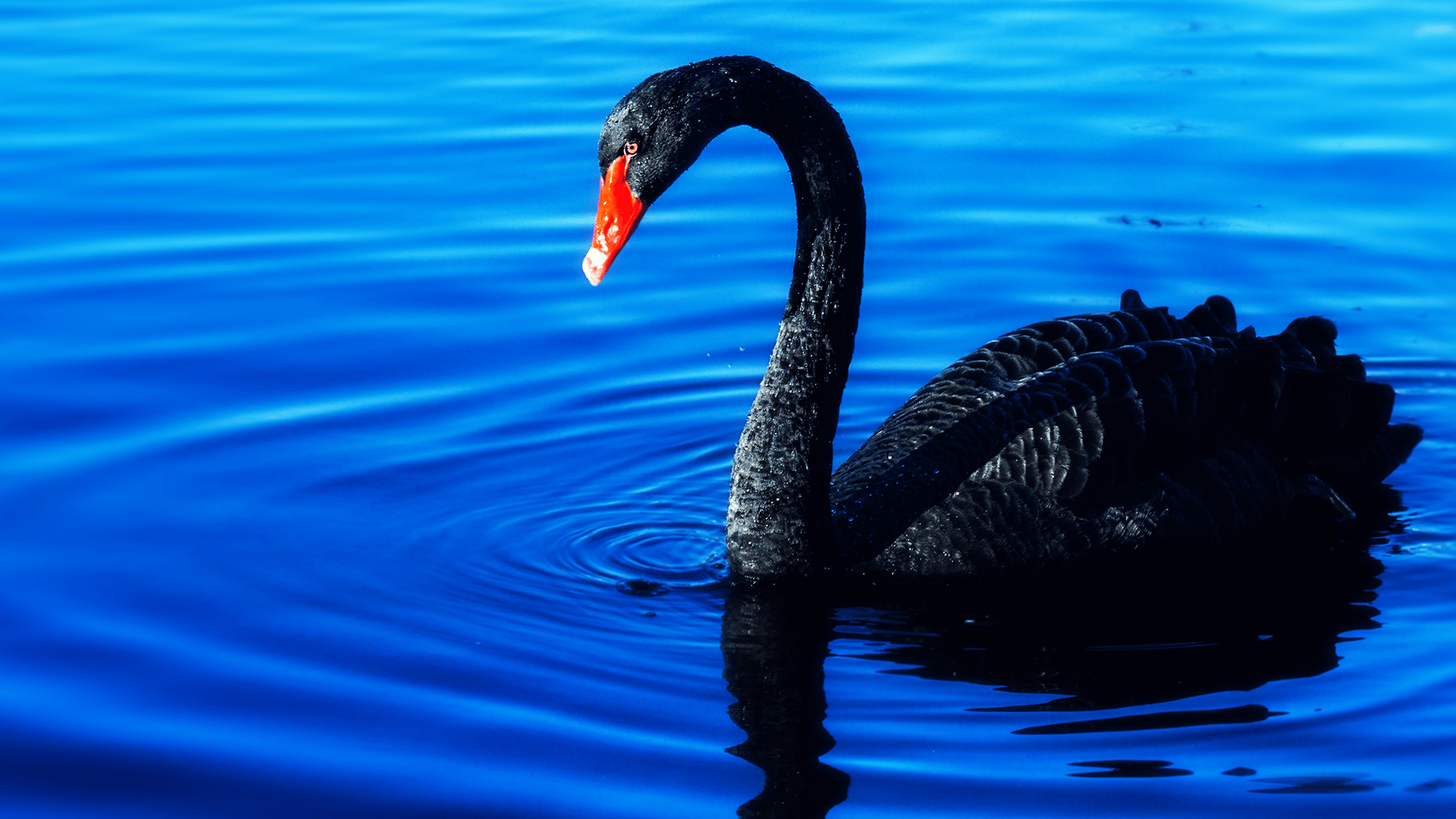

At the end of the day, it is, as Rumsfeld said, about: “the things that you think you know that it turns out you did not” – about those ‘black swans’ that can derail your plans without warning.

Poor diligence leads to a false sense of security & may leave you at the mercy of black swans.

The latest excuse is ‘soft factors‘ but this isn’t correct. If you refer back & start with the data, this will also ease quantification of ‘soft factors’ too.

At the end of the day, it is, as Rumsfeld said, about: “the things that you think you know that it turns out you did not” – about those ‘black swans’ that can derail your plans without warning.

Poor diligence leads to a false sense of security & may leave you at the mercy of black swans.

The latest excuse is ‘soft factors‘ but this isn’t correct. If you refer back & start with the data, this will also ease quantification of ‘soft factors’ too.

The answers lie in the data foundations.

red pill or black swan?If you’re on the acquisition trail, you’ll get the bad along with the good, eventually impeding your ability to grow organically.

If you’re an acquisition target, you’ll want to put your best foot forward & not be sandbagged by any ‘surprises’.

If you’re a sleep-deprived CEO, use Incorvus as your diligent & critical friend.

it’s your choice!